Despite the rise in inflation and interest rates over the past two years, “nearly all borrowers continue to service their debts on schedule”, according to the latest Financial Stability Review from the Reserve Bank of Australia (RBA).

“Households with lower incomes, including many renters, have felt these budget pressures acutely,” the RBA said.

“Most mortgagors have experienced an increase in their minimum scheduled payments of 30–60% since the first increase in the cash rate in May 2022. Sharply higher housing costs (for borrowers and renters) and broad-based cost-of-living pressures have weighed heavily on the budgets of many households and contributed to very weak consumer sentiment.”

Nevertheless, borrowers have found a way to get by.

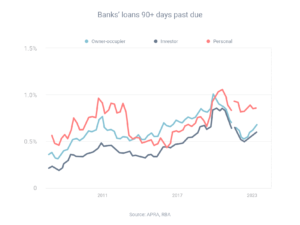

“While housing and personal loan arrears have increased since late 2022, they remain below their pre-pandemic peak,” the RBA said.

“At the same time, a small but increasing share of borrowers have requested and received temporary hardship arrangements from their lenders, which has contributed to arrears rates remaining a little lower than would have otherwise been the case.”